BUILD THE LIFE OF YOUR DREAMS

Unlock Your Financial Strength Today!!!

Gain Liquidity, Efficiency and Control

Strategy used by 90% of millionaires to reach their goals 4x faster!

Become Efficient and Take Control of Your Cashflow

YOU SHOULD NOT FEEL OUT OF CONTROL OF YOUR FINANCIAL STRATEGY

Learn how to address all your biggest concerns

Gain liquidity and control so you have easy access to your money in case of emergency or opportunity

Learn to diversify and position yourself so you have a clear plan to avoid market uncertainty and be in a buying position to take advantage when opportunity arises

Discover tax advantages so can earn true uninterrupted compound interest and you do not overpay in taxes later

Gain peace of mind with a plan with guaranteed and predictable interest to keep up with inflation and protect your purchasing power

Reclaim control and efficiency over the financing aspect of your life so you can say goodbye to bad debt and high interest rates

Gain enhanced benefits, beyond your own capital, further protecting your real estate and investments in the event of major illness or unexpected death securing your family's future

Stop guessing at the best vehicles to best protect and grow your money

Learn how to have your money perform multiple functions in your life so you can be efficient and improve your life year after year

WHO IS THIS PROGRAM FOR???

INDIVIDUALS LOOKING FOR MORE CONTROL OVER THEIR FINANCIAL LIFE

Tired of making your decisions based of finances? Learning to become efficient with your money will help you gain control so you create the life you want based on your values

BUSINESS OWNERS LOOKING TO MAXIMIZE THEIR DOLLARS

Are you looking for a financial strategy that will take your best assets (you and your businesses) and multiply their potential? Our Cash Flow hacking strategies will teach you how to invest for the future without sacrificing building your business

PEOPLE LOOKING FOR AN ALTERNATIVE INVESTING STRATEGY (SUCH AS REAL ESTATE)

Are you a real estate investor who is burned out from being a landlord or playing the fix-and-flip game? Our Cash Flow Hacking strategies will provide you with the system to create predictable wealth AND give you the freedom you are looking for.

I.C. Life Financial

Efficiency Strategist

Marissa Cozzolino

SCHEDULE YOUR FREE CONSULTATION TODAY

You're tired of feeling like you aren't getting anywhere with your finances and that sense of not having control of your money. You make good money but still feel like you lack the freedom you are striving to create. You invest into your future retirement but still lack control of your money. You are tired of the high fees, uncertainty of the stock market, and not having your money liquid for better opportunities. Maybe you even got index universal life because somebody told you it was a "risk free, tax free retirement account," only to find out the truth that now your money is under a surrender penalty, the plan has major risk when you pull your money out, and you still have to worry about taxes. Much of what is being sold out there is to make the seller rich,

NOT YOU

We believe this is wrong and that your security and best interests should be placed first. We believe you should be in a position where you control your money, your money doesn't control you. We understand because we talk with hardworking people everyday that are losing money in the markets based on old information and feel like they are guessing at the best course of action.

At I.C. Life, we are passionate about giving people control of their money and their future. We believe your capital is a tool and that you need access and leverage in case of an emergency and to take advantage of opportunity.

Our passion comes from our founder, Michael Anthony Garcia. His passion comes from going through his first 15 years of his professional life, doing what he was "supposed" to be doing. Get a good job, invest in the company's 401k. However, despite the savings and owning a home as well, he still felt a lack of control with his money. With inflation and other rising costs, he still felt he was living paycheck to paycheck.

After going on a journey to find financial freedom and control, his life changed. He quit the job and focused on bringing value to people. He found freedom. He aligned his money with his values and found purpose in helping others do the same. With a new focus on control and alignment, he had two major regrets in his financial life.

Regret #1: After buying his first property at 24 years of age, he would sell it for little profit to make things easier on his budget 8 years later. Now at 40, and with a better understanding of money, it is easy for him to see the life with a potentially paid off mortgage or even a cash flowing property that would increase his lifestyle dramatically. Not to mention, access to capital through his home equity.

Regret #2: Investing into the company 401k at work. Despite actually getting decent performance out if his 401k, he regretted this because of the control he gave up in doing so. He subjected his money to taxes and penalty which make this money non-liquid. This caused him to miss out on two other real estate opportunities that he could have taken advantage of if he had liquidity and leverage. Coming from a family where his grandparents and aunt are real estate investors, he knew the value of real estate and building cash flow. What he didn't realize was the opportunity costs, he didn't realize what that 401k would truly cost him.

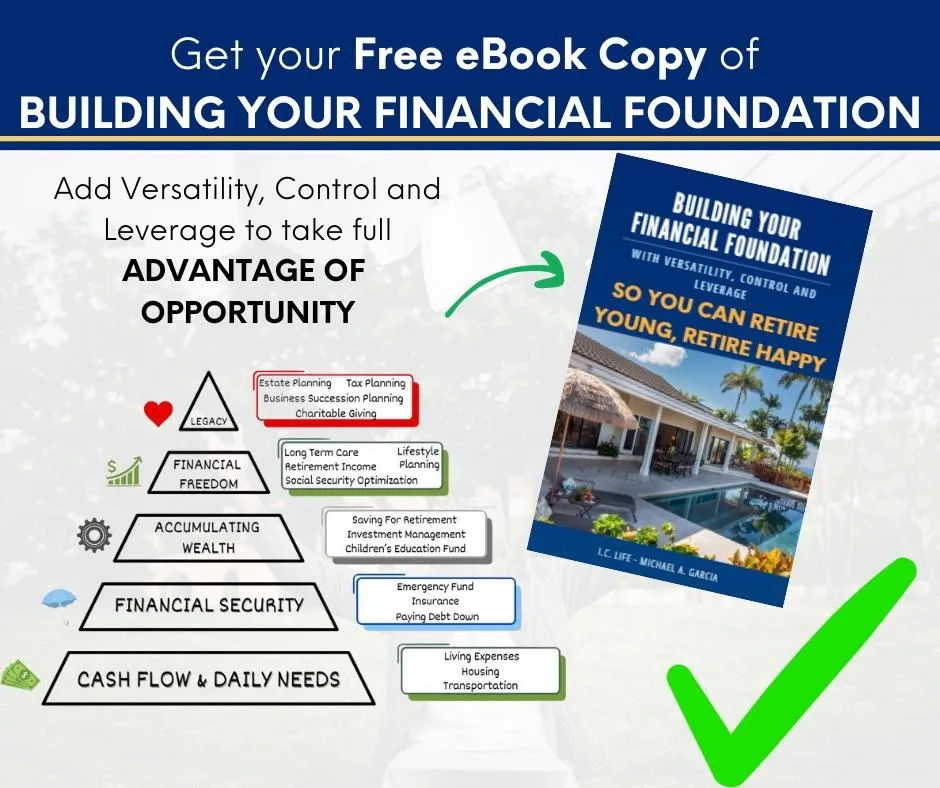

You have been lied to. Or at least passed down outdated information. Go to school, get a good job, save in a 401k just doesn't work. With inflation and rising cost eating away at our money, the separation of the upper and lower class is growing wider and wider. There is a way to catch up though. There is a way to keep control and liquidity of your money while it grows. A way to position yourself to acquire real estate, invest in your business venture, or even capitalize on the next market crash while everybody is losing and in a state panic. There's a reason investors, like Warren Buffet, don't put all their money in the market and keep access to liquid capital. Did you know that 90% of millionaires in the United States have 1 asset in common?

Hint: it's not stocks or mutual funds (and no...it's not crypto). How much sense does it make for you to work hard, save money, reduce your current lifestyle (because that's what you are doing when you save for the future - taking money you could use on lifestyle today and delaying gratification to a future unknown time), and hope that whatever you are doing will work three to four decades from now? If you're thinking, "not much sense at all…", you are in the right place.

With over 50 years of experience on our team, we have worked with thousands of individuals and families to achieve financial freedom faster and with more predictability by helping them invest for Cash Flow.

How does Financial Efficiency Coaching work?

First, schedule your free consultation. We will take the time to understand your goals. We believe in education first and we believe you deserve the best financial education. Next, we will take a look at your current budget and see what areas we can be more efficient, this could include a debt action plan to eliminate monthly minimums that have creeped up, or idenifying areas you are spending too much so we can lower your costs and redirect your money and put it to work for you. Next, take this money, plus any other money you want to put towards your future, and we protect and grow your assets. We understand that you are your number one asset so we make sure your income and ability to earn is also protected. We will show you how to do this predicabilty and with guarantees. Lastly, we position you to increase your cash flow. This is our ultimate goal, turning your savings and spending into cash flow.

At I.C. Life, we are a community of people who are seeking more out of life, people who want to be hero's for their family, people who challenge the status quo. We encourage you to join our community and take this journey to a better future together. Click the button to schedule your initial consultation and start your jouney toward financial freedom today!

ARE YOU READY???

Start taking advantage of opportunity!